A rapid loss of over 5 billion dollars on global stock markets has led some experts to compare Trump’s trade war to the Wall Street crash of 1929.

Donald Trump’s trade war has thrown global financial markets into the steepest decline since the Covid pandemic five years ago.

Leading economists have issued a series of warnings about the negative effects of the commercial tariffs imposed by the American president, and comparisons between what Trump has termed "Liberation Day" and the Wall Street crash of 1929 or the great economic crisis of the '30s are inevitable.

Over 5 billion dollars have been wiped off the value of global stock markets since Trump's resolute speech in the Rose Garden at the White House last week.

Investors are now expecting additional volatility, as Washington does not seem to be backing down.

On Wall Street, the S&P 500, one of the leading stock indices in the US, is approaching "bear market territory" - when an index falls by over 20% from its recent peak – in one of the largest market declines in history.

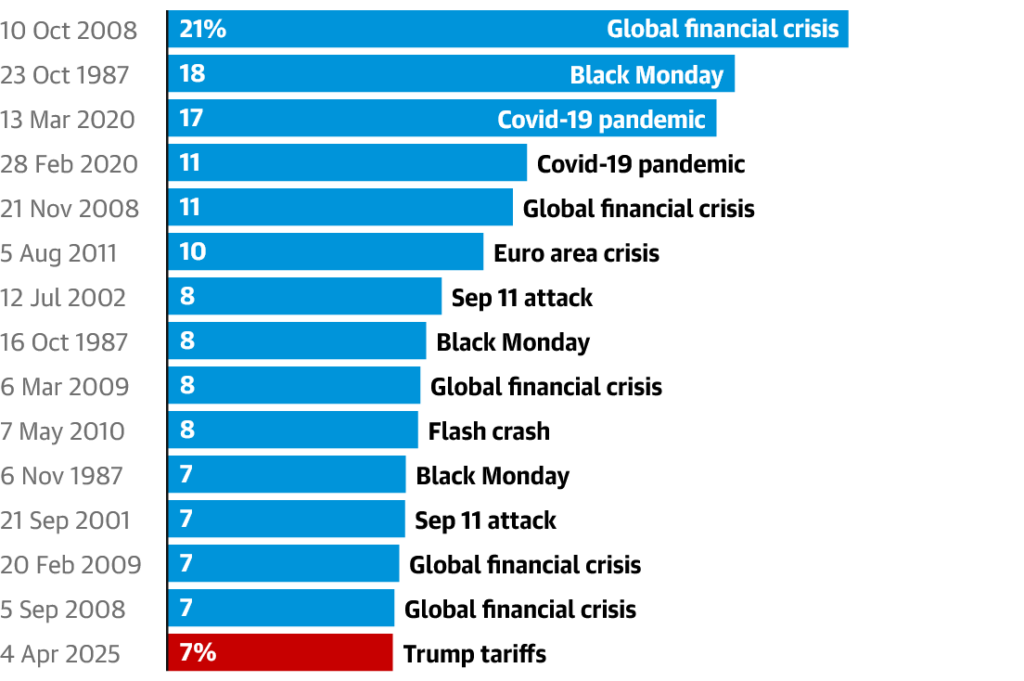

The Guardian shows where the effects of "Liberation Day" currently stand compared to some of the biggest economic crises in history.

Here is a review of the most significant financial crises in history:

The Wall Street Crash of 1929

It was the biggest setback for the global economy in the modern industrial era. The Wall Street crash of 1929 followed a speculative stock buying frenzy, creating a market bubble. The subsequent crash triggered the Great Depression of 1930 and set the economic climate that led to World War II.

On "Black Thursday," October 24, the Dow Jones industrial average dropped by 11%. This was followed by a 13% drop on Monday and another 11% drop on Tuesday. The downward spiral lasted until June 1932, with New York Stock Exchange-listed companies already losing 90% of their value at the lowest point.

"Black Monday" of '87

The first major global financial crash of the modern era, caused once again by a speculative bubble in the boom and crisis of the '80s. The Dow Jones recorded the largest single-day drop in history, with a value of -22% on October 19.

The London market also crashed, exacerbated by the closure of the stock exchange on Friday due to transportation chaos caused by the Great Storm of 1987. As traders in the city were unable to return to their offices, computerized automated trading accentuated the disaster, leading to a 10.8% drop in the FTSE 100 on Monday, with an additional 12.2% drop the following day.

The dotcom and 9/11 Crisis of 2000

The frenzy of the '90s Internet company stock market listings led the FTSE 100 to a peak of 6,930.2 recorded on December 30, 1999 – a record that would endure for 15 years.

However, the bubble burst on March 10, 2000, when international stock markets suffered massive declines. And the terrorist attacks of September 11, 2001, brought the index down to a level of 3,287, recorded as the US-led coalition forces were preparing for the invasion of Iraq in 2003.

The Financial Crisis of 2008

Lehman Brothers filed for bankruptcy on September 15, 2008, at the crossroads of the most severe post-war financial crisis. Global markets had been deeply troubled for some time, amid the expansion of the credit crisis, generated by the subprime mortgage market in the US.

On the day of Lehman's collapse, the FTSE 100 dropped by 4%, a relatively limited level, but then it was to lose almost a third of its value in 2008, as a result of the global financial crisis.

The company failures and fears of the international recession it triggered led to some of the most abrupt daily trading losses in history, with a nearly 9% loss on October 10, marking the peak of the chaos.

The Brexit Vote of 2016

The UK's shock decision to leave the EU caused the pound to drop to its lowest level in 31 years and wiped over $2 billion off global financial markets, marking the biggest losses on the FTSE 100 and European trading centers.

The FTSE 100 plummeted by 8% in the first minutes of trading, but partially recovered after Mark Carney, the then Governor of the Bank of England, promised not to hesitate to take measures to stabilize the markets and the economy. The FTSE 100 closed the day down by 3.2%.

The Pandemic-induced Crisis in 2020

The forced halt of the global economy during the Covid pandemic triggered panic in financial markets and the deepest recession since the Great Depression of the '30s.

Major benchmarks on global markets crashed in a matter of hours and days. Over eight years of gains on the FTSE 100 vanished in less than a month, while global stocks swung between the best and worst sessions in a decade in consecutive days.

The FTSE 100 recorded its largest daily drop since Black Monday, of nearly 11%, while the Dow fell by approximately 13% on March 16.

However, the swift intervention of central banks and governments has contributed to injecting a strong change into financial markets.

T.D.