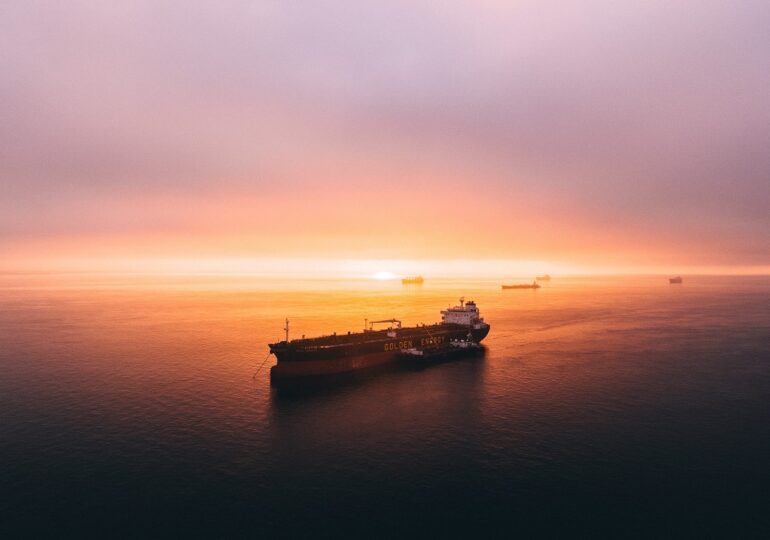

The Middle East is the most important oil-producing region in the world and a major center for maritime trade.

Its waterways are a critical artery for cargo ships transporting oil and container vessels with goods and equipment, commented Sky News.

Conflicts in the Middle East have a predictable impact on oil prices, causing a sudden increase as investors fear supply constraints due to possible blockades and attacks on these maritime routes.

As a result, marine insurance premiums also rise, which are ultimately passed on to the consumer.

- LIVE The Israel-Iran conflict escalates. Multiple explosions in Tehran, Tel Aviv, and Jerusalem (Photos & Video)

- Israel's air power and Iran's nuclear bunkers could lead to a protracted conflict

Brent crude, the international benchmark, has risen by 8%, reaching $75 (55 British pounds) per barrel.

This has repercussions throughout the economy, as oil is involved in the manufacturing process of many goods and services, whether it's plastic toys or air transportation.

According to the International Monetary Fund (IMF), inflation in advanced economies increases by approximately 0.4 percentage points for every 10% rise in oil prices.

Some experts remain optimistic about the impact on trade, but the region is already facing challenges.

Houthi rebels, supported by Iran, have attacked ships passing through the Red Sea towards the Suez Canal - a crucial node for container shipping.

"This has forced many ships to travel the long distance around Africa on the routes between Asia and Europe, adding one to two weeks of travel time and approximately $1 million to the cost per journey," said Sarah Schiffling, a professor at Hanken School of Economics.

- Israel's attack on Iran signals Trump's total diplomatic failure and opens the gates of war

- Mossad humiliates enemy services: Introduced weapons, drones, and agents into Iran without being detected

Additionally, Iran has repeatedly threatened to block the Strait of Hormuz, which connects the Persian Gulf to the Arabian Sea.

The strait handles a quarter of the world's oil trade, and analysts at Goldman Sachs predict that blockades in the Strait of Hormuz could push prices above $100 (74 British pounds) per barrel.

This would be an extreme step for Iran, which would anger its main client - China - as well as Qatar and the United Arab Emirates (UAE), two other major oil-producing states that also depend on the strait.