What happened in Dobrogea in recent days is, although shocking, the future we increasingly need to expect. Climate change is a reality that only conservative fanatics can deny, ignoring the palpable dramatic effects.

Therefore, the question is not whether such events will reoccur. They will certainly reoccur. The question is to what extent we are prepared for them.

At the macro level, both at the local and central authorities, unfortunately, realistic expectations can only be modest primarily due to the increasingly weak competence of those who populate and lead the institutions.

Even more so in these conditions, the issue of individual preparedness arises.

Surely, the people affected by the floods in Dobrogea, who saw their belongings and even homes destroyed, deserve all the compassion. But beyond that, there is a question that most have avoided asking: how many of those affected had their homes and belongings insured?

And I am referring especially to the mandatory disaster insurance - PAD. One of the women who sadly watched her home destroyed by the floods admitted she did not have it. The rest did not specify and were not asked.

The vast majority most likely do not have insurance. And I rely not only on their statements, which suggested they lacked such support, but especially on the fact that, according to official data, in 2023 only a fifth of the homes in Romania were insured. Despite, I repeat, insurance being mandatory.

The annual insurance premium is 130 lei for homes made of modern materials and 50 lei for those made of adobe.

It is very hard for me to believe that 80% of homeowners in Romania cannot afford to pay 130 lei/year, which is less than 11 lei/month. Not even the cost of a pack of cigarettes.

Let alone discussing optional home insurance, which covers risks other than natural disasters, or insurance for belongings.

Why isn't the obligation obligatory?

Theoretically, the 80% of homeowners without PAD insurance should be fined amounts ranging from 100 to 500 lei by the municipality, which, in turn, would have the obligation to periodically check in the PAID system which homes are uninsured and to summon those who have not complied.

But the mayor asks for votes every 4 years, why should he stir up trouble with people for such a thing?

And why should people give up a pack of cigarettes or a large PET bottle of beer for insurance, as nothing ever happens to them anyway. Until it does.

But even then, to score politically and to silence the mourning television channels, politicians come up with some money, with some building materials.

Of course, there are homes that cannot be insured, those built without permits in flood-prone areas, those in seismic risk class I. But they still exist because the irresponsibility of the owners met that of the local authority.

Distrust in the insurance system is also invoked, considering experiences with RCA policies. PAD insurance is issued by the Disaster Insurance Pool (PAID), which has 12 large insurance companies as shareholders. PAID is in turn externally reinsured.

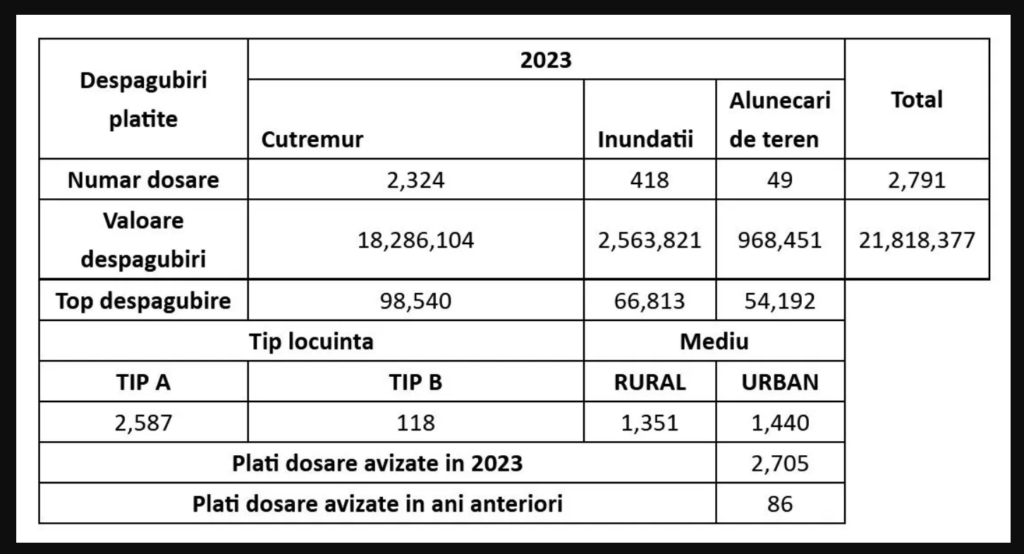

There is no perfect, fraud-proof system, but so far there have been no issues. Hotnews published last year's PAID data.

Ultimately, at least from such misfortunes, we should understand that being a homeowner means not only having rights but also corresponding obligations, that compliance with rules is a sign of intelligence, and that everyone is responsible for their own life and belongings.