One of the definite benefits of shifting all labor taxes from the employer to the employee, with a corresponding increase in gross salary, in 2018, is that from that moment on, the employee can see month by month on their pay slip how much of the money they earn goes to the state.

And what do they see? That from the gross salary, the state takes 10% tax, 10% health insurance – CASS, 25% social insurance for pension and unemployment – CAS, so almost half.

The salary tax is not high, but the rest of the taxes are burdensome, among the highest in the EU, and, perhaps worst of all, the money does not return in quality public services.

The healthcare system is full of problems and people are often forced to incur additional expenses that frustrate them, pensions are low, and other public services funded from the budget, such as education or police, are still at very low levels.

Meanwhile, governments have introduced and maintained a new tax, called inflation, generated by expenditures far exceeding revenues, on deficit. Public debt increased in January and February by almost 8 billion euros and reached 52% of GDP.

All interventions in the free market on prices have not had and could not have good effects. Did you force down the price of milk on the shelf? The store raised the price of detergent. And so on. This is how we have the highest inflation in the EU.

Public sector employees go and ask the Government for extra money with very high chances of obtaining it in the multiple electoral year, with a predictable inflationary effect. But those in the private sector know that asking the haggard and burdened employer for extra money is futile.

This is why for the first time this week we saw a protest whose main demand was the reduction of labor taxes, not salary increases.

But which taxes and how can they be reduced?

A decrease in CAS would increase the chronic deficit of the pension budget just when the Government promises recalculation, with an additional cost of 10 billion lei just this year. Certainly, savings could be made through an authentic reform of special pensions, but a real solution is to expand the collection base. Meaning more contributors to the pension budget.

How do you gather them when you are the country with the highest labor force migration in peacetime conditions? When the fleeced people seek any solution to mask their incomes, even if the price in old age will be very high?

Without well-thought-out, well-targeted social policies that keep Romanians in the country and bring back those from abroad, without a stimulation of the private sector to create well-paid jobs, you have no chance to increase the collection base.

Then, pillars II and III of the pension system must be developed, which amplify contributions through investments. The private pension Pillar II had a record yield of 17.9% in 2023. The political class, on the other hand, fusses around Pillar II, like around the honey jar, and keeps trying to get their hands on it.

The health contribution seems high when compared to the services actually received in return. But theoretically, with 10% of the income of a minority, almost complete medical assistance is supported for almost everyone.

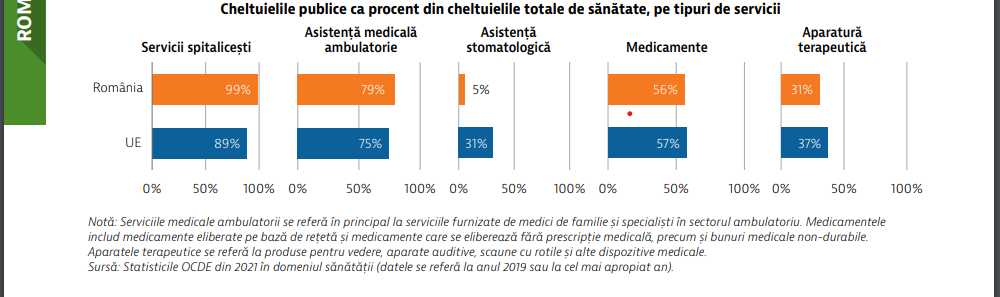

The public health insurance system in Romania is not sustainable starting with the fact that the insured basic package theoretically covers almost all hospital and outpatient medical services. This is what the 2021 Country Health Profile shows: public expenditures for services and goods are above the EU average.

In practice, many of the services theoretically covered by public insurance end up being paid out of pocket, expensively, in the private sector, because the public system cannot cope.

There are still many non-paying CASS beneficiaries, exempt for various reasons, and a limited collection base for valid reasons and for CAS.

Of course, waste, corruption, theft, incompetence worsen things, but the real solution is to develop the private health insurance market with two effects: an infusion of money into the healthcare system, much better control of expenses because the private insurer scrutinizes a bill from all sides before paying it, and healthy competition.

Models for the development of the private health insurance market exist, there is no need to reinvent the wheel, but the decision involves unpopular reforms whose political cost no one wants to bear.

There is an increase in the private health insurance market in Romania, it has doubled in the last 5 years, but being predominantly supplementary, i.e., for the few services not covered by CASS, 80% of medical services in Romania are still paid for from public sources. Which, in the conditions of a population with high morbidity, for many reasons, including lack of prevention, is extremely high.

In short, under the de facto monopoly of the Health Insurance House, neither services can be better nor taxes lower.

Reducing labor taxes is not a simple accounting operation, it must be backed by well-thought-out policies, which the current political class is incapable of in terms of both competence and electoral cost.