If someone wonders why at ECOFIN, the meeting of Finance Ministers of the European Union, the Bolojan plan to reduce the excessive deficit was approved, the answer is in the decision to increase VAT by two percentage points. That is a rapid influx of 10 billion lei, approximately 2 billion euros, into the state treasury with a simple condition – the value-added tax not to be stolen.

The increase in VAT was a risky decision because it may have negative effects regarding inflation, consumption decrease, and public opinion reaction.

In order to reduce the deficit from 9.3% of GDP, recorded at the end of last year, to 7.5%, as negotiated for 2025 with the European Commission to avoid entering into the excessive deficit procedure, which would have blocked funding through the PNRR and access to European funds, the Romanian Government must find 30 billion lei, around 6 billion euros, obtained through increased revenues and reduced expenses.

If 2 billion euros come from the increase in VAT rates, the remaining 4 billion are planned to come from 10% higher excise duties on tobacco, alcohol, and fuel, a 10% CASS contribution for pensions over 3,000 lei, and a 6% increase in dividend tax.

Scandal over others' mistakes

In the afternoon of June 19, a month after the end of the presidential elections, when a large part of the general public awaited the nomination of Ilie Bolojan for the position of prime minister by the new president Nicușor Dan, a series of informal sources emerged stating that the PNL leader might give up, due to disagreements that arose between the two regarding the VAT increase.

"... I start the discussion with the coalition from what I said in the electoral campaign that VAT should not be increased... All I can say is that I start from this premise in discussions with the coalition," stated Nicușor Dan, in his first press conference held at the Cotroceni Palace, after taking over the presidency.

In the end, Ilie Bolojan became the Prime Minister, imposed the VAT increase, and the relationship with President Nicușor Dan remained tense.

"We did not have disagreements regarding the package, because it is a Government commitment, but Mr. President asked me as much as possible not to increase VAT, to generally maintain taxes at the level we had. The package we want to implement cannot evade tax increases," stated Ilie Bolojan in a recent interview.

A remaining 13 billion euros

But the main problem of the authorities in Romania related to VAT is not the tax increase, but the collection. Our country records the lowest VAT revenue recovery rate in the entire European Union.

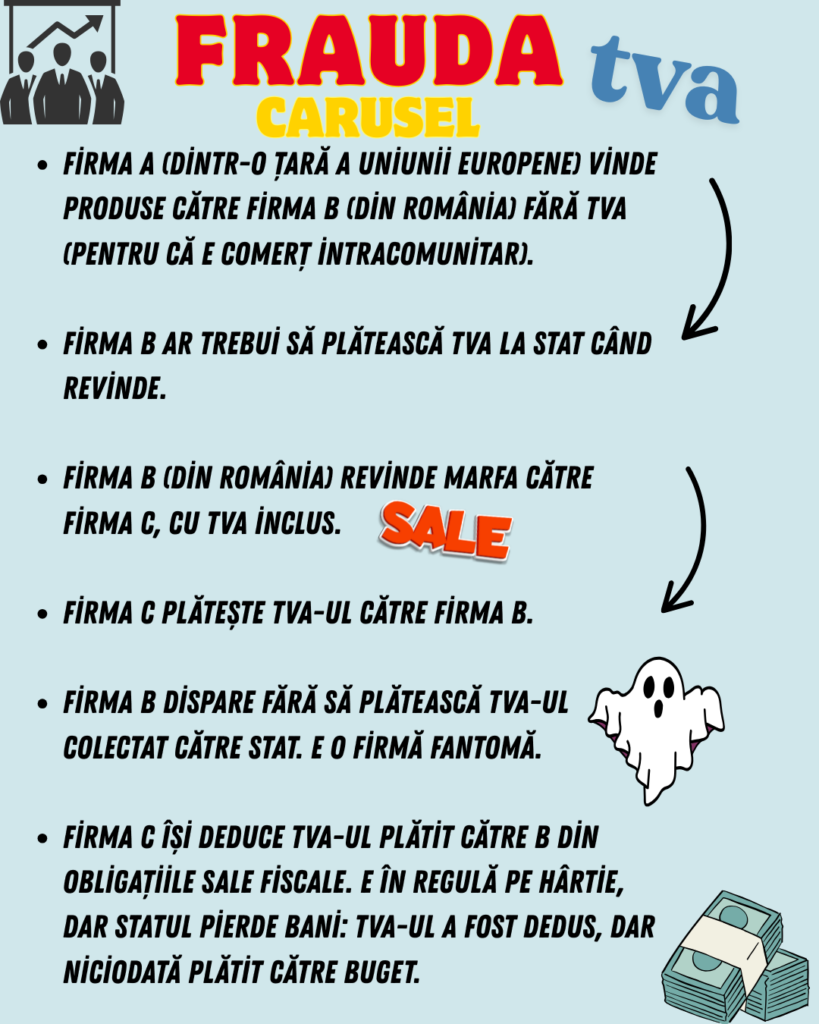

Out of the total tax, only 65% reaches the state budget, the rest turning into illicit revenues for criminal networks in the country and abroad, which have reclaimed it from the state with false documents.

According to estimates, in 2024, ANAF collected 24.2 billion euros from VAT, representing 64% of the total. The remaining 13.6 billion euros did not make it into the state's coffers.

"Romania has one of the most persistent gaps in terms of VAT: it still loses about a third of the total that should be collected, and in 2022 (the latest estimate of the VAT gap in the EU), the nominal value of these losses exceeded 8 billion euros.

Romania introduced electronic invoicing at the beginning of this year and hopes to improve its performance in terms of revenue collection," announced Aradhana Gole in the specialized publication VAT Calc in an article published in June 2025.

Following intense and complicated negotiations at the European Council meeting in July, we managed to obtain a budgetary package of around 80 billion euros for Romania for the next 9 years. These funds represent a historic opportunity to develop Romania in the medium and long term.

Klaus Iohannis, speech November 26, 2020

During the 2014-2023 period, Klaus Iohannis' mandate, Romania lost around 78 billion euros only from uncollected VAT, according to reports submitted to the Ministry of Finance for this interval. That is equivalent to the entire amount made available through the PNRR and European funds for the current financial exercise, totaling an estimated 80 billion euros.

A consequence of corruption

No Romanian state official reacted to the financial catastrophe, no institution or governmental agency informed the population about the proportions of the theft, no prosecutor took action regarding this phenomenon.

The conspiracy of VAT diversion unfolded with the complicity of those in power, while financial experts frequently warned about the huge losses recorded in the collection process of the respective tax.

"There is no saving recipe against tax fraud and evasion, but the experience of other countries where the VAT deficit has significantly decreased shows that a modernization of the tax administration based on digitization is one of the best practices," announced Bianca Vlad, Partner, Tax Advisory, Mazars Romania, back in 2020.

"Real-time access of tax authorities to transactions carried out by economic operators, electronic control such as e-audit... are tested tax compliance methods that are beneficial for both taxpayers and authorities, making tax control much more efficient.

The best example in this regard is our neighbors in Hungary, who in 2018 had the largest decrease in the percentage of uncollected VAT recorded in the EU, by 5.1%, after implementing real-time reporting of business to business transactions," explained expert Bianca Vlad at the time.

Klaus Iohannis, Nicolae Ciucă, and Marcel Ciolacu cannot say they were unaware of the seriousness of the situation, but they and their representatives, despite continuously talking about digitization, did nothing, billions of euros being diverted under their authority.

Tax increases are a direct consequence of the endemic corruption that has engulfed many state institutions. With a stalled reform and increasingly sophisticated mechanisms for embezzling public funds, Romania has been brought to the brink, and citizens are once again called upon to save it.